Bitcoins, Baby!

Photo by bermix studio on Unsplash

Ain’t they cute, all these memes going on in one small photograph?

I love Medium! It’s the gift that keeps on giving. Just when I’m out of story ideas, along comes another post to play with. Consider this take on cryptocurrency:

“If there is one thing economists don’t like, it is wasted resources. And if you look at Bitcoin, it is using the electricity generated by a reasonably sized country like Sweden. But you know who else is using the electricity generated by a reasonably sized country like Sweden? Yes, Sweden. And economists don’t particularly seem to mind Sweden. Many of the economists named above really love Sweden.” from Why Economists Don’t Like Bitcoin by Joshua Gans

So concluding the above argument, we need to shut down Sweden. Sounds pretty extreme, but those damn Swedes don’t contribute much except Volvos and nice tour packages—and they’re wasteful as hell because—they’re exactly like Bitcoin? Might that argument have been better posed?

In truth, the obscene quantities of energy squandered doing essentially what a well-printed dollar bill does relatively efficiently—mainly discouraging counterfeiting—is what makes this whose Ponzi scheme absurd. It doesn’t need an economist to tell you, either.

Once you understand the waste produced in the manufacturing of, say, microchips—or solar panels, you grasp the concept of no free lunch, er energy. At least both of these offer socially redeeming value, unlike digital currencies. Mind, it does offer value, even if social redemption isn’t part of it.

“The story so far: Bitcoin, the first and biggest cryptocurrency, was introduced in 2009. It uses an encryption key, similar to those used in hard-to-break codes—hence the “crypto”—to establish chains of ownership in tokens that entitle their current holders to… well, ownership of those tokens. And nowadays we use Bitcoin to buy houses and cars, pay our bills, make business investments, and more.

“Oh, wait. We don’t do any of those things. Twelve years on, cryptocurrencies play almost no role in normal economic activity. Almost the only time we hear about them being used as a means of payment—as opposed to speculative trading—is in association with illegal activity, like money laundering or the Bitcoin ransom Colonial Pipeline paid to hackers who shut it down.” from Paul Krugman’s 2021 piece in the NY Times, Technobabble, Libertarian Derp and Bitcoin

Krugman’s point being what socially redeeming value do cryptocurrencies possess?

Boy, if I just had a few bitcoins, my life would be complete.

I’m wasting away for the want of bitcoins.

I’d be a slut for bitcoins.

…

Joshua Gans’s headline, Why Economists Don’t Like Bitcoin, is catchy, assuming you’re into economics like he is, but the article produces very little heat. Most rational people suspect bitcoins are a passing fancy, but we don’t prattle on about it. A recent article in the Washington Post put the answer to the question this way: digital currencies are a solution in search of a problem.

The charts included in Mr. Gans’ article, I suppose, are to say he’s done his research, but since you can’t read them, I’m not sure. And I don’t see how telling us other people’s opinions in a survey brings much candlepower to the subject, speaking of energy usage.

Entropy rules. Always has. But the energy to print $1,000 in U.S. bills is a tiny fraction of what it to produce the same amount in bitcoins. Extracting gold? Same thing. Energy isn’t inexhaustible, and it’s hardly free, so what we collectively choose to spend it on is important.

In all cases, money is a medium of trade, subject to the same forces—from altruism to manipulation, theft, greed, corruption, et al. Figuring out how to make those trades as efficient as possible is the antithesis of bitcoins.

“How economists declare something to be waste—and there can be waste—is by identifying a market failure? When it comes to Bitcoin, when pushed, economists identify electricity usage as being socially underpriced. [1] Why? Because it is generating pollution and pollution is a quintessential market failure.

“But here’s the problem with that. That argument may be true but it is not particularly true of Bitcoin. Basically, Bitcoin involves the same waste as using a fridge. Both are subject to the same market failure. Can we really say one is worse than the other?” from Why Economists Don’t Like Bitcoin by Joshua Gans

[1] To translate the econ-speak, what Gans means to say by ‘socially underpriced’ is that the true cost of electricity is far greater than we admit given pollution—and global warming resulting from it. So why doesn’t he say that? Professional jargon is a curse of the illiterate.

When in doubt, always mention market failures, and you may even make tenure. I suspect the only people who believe electricity is ‘socially underpriced’ are Dominion Power and Duke Energy bond holders.

And actually, yes, we can say one use is worse than another. A refrigerator keeps food stored longer, particularly in hot climates. At Clemson, in the old ‘tin can’ dorms we used to keep our beer stored outside on the ledges—but it only worked in the winter, so if you had to attend summer classes you were screwed. Only the upperclassmen could afford refrigerators in their dorm rooms. Hamburger meat doesn’t keep well at 100 degrees—and we didn’t even need to go to Econ 101 to learn that…

Pollution is a consequence of everything we do, from breathing to breaking wind—and it’s hard to tell the difference sometimes. Gans might want to define his jargon before writing for a general audience, speaking of market failures. It may surprise him, but some human activities have more value than others.

…

Digital currencies are stellar at only one thing, feeding into that age old vice called gambling. Oh, and helping move the drug lords’ loot.

Back in the 70s, the Miami Herald pointed out the Miami Federal Reserve held a staggeringly large percentage of Ben Franklins compared to the rest of the Federal Reserve system. Given South Florida’s role in the importation of marijuana and cocaine from South America, along with money laundering of ill gotten gains of dictators and their loyalists, nothing smaller than hundred-dollar bills would work for large transactions. With bitcoins now a currency of choice among dodgy importers and tycoons, has there been a noticeable decline in demand for Ben Franklins lately?

…

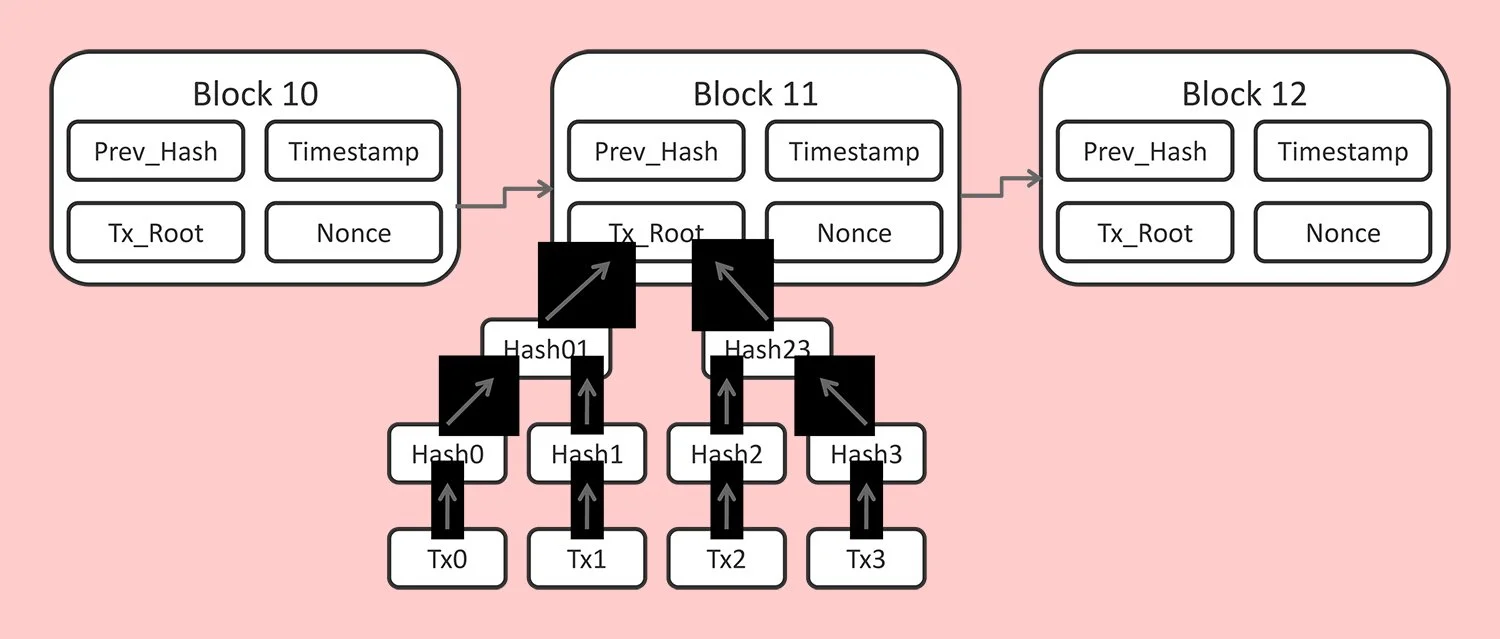

For just a wee dip of the toe into the arcanal science. In truth, the math isn’t of a higher order—well below calculus. It’s called blockchain. As in a chain of blocks, each block being hashed simultaneously by peer-to-peer networks, all sucking those joules big time (and no doubt a few joints). See how easy that is?

Hashing used to mean crazy runners going between beer joints, so they were called hash house harriers. The techies stole another community’s main verb to mean a jumble of cryptographic nonsense impossible to separate like old potatoes and meat… where was I?

Bitcoin block data diagram—by Matthäus Wander - CC BY-SA 3.0

“A blockchain is a growing list of records, called blocks, that are securely linked together using cryptography. Each block contains a cryptographic hash of the previous block, a timestamp, and transaction data (generally represented as a Merkle tree, where data nodes are represented by leafs). The timestamp proves that the transaction data existed when the block was published to get into its hash. As blocks each contain information about the block previous to it, they form a chain, with each additional block reinforcing the ones before it. Therefore, blockchains are resistant to modification of their data because once recorded, the data in any given block cannot be altered retroactively without altering all subsequent blocks.

“Blockchains are typically managed by a peer-to-peer network for use as a publicly distributed ledger, where nodes collectively adhere to a protocol to communicate and validate new blocks. Although blockchain records are not unalterable as forks are possible, blockchains may be considered secure by design and exemplify a distributed computing system with high Byzantine fault tolerance.” from Wikipedia article on Blockchain

William Butler Yeats’s famous poem Sailing to Byzantium may be a useful reference.

…

When blockchain algorithms were first programmed, tech gurus said their arrival on the tech scene portended great things afoot.

Blockchain technology relies on the power of encryption at scale enabled by modern computers. Bookkeeping (in all senses) at a scale unimaginable fifty years ago, combined with the ability for transactions to remain anonymous. Using a gazillion joules of electricity per block. And the best thing? Each transaction is recorded, never ever to be deleted. Databases each the size of Elon Musk’s ego are growing exponentially, and they haven’t even been around ten years. Imagine the largest sow you ever saw at the county fair, and still growing.

“Blockchain… serves as a ledger that allows transaction[s] to take place in a decentralized manner… Blockchain combines a distributed database and decentralized ledger without the need of verification by [a] central authority… There are still many challenges of this technology, such as scalability and security problems, waiting to be overcome.

“The consensus algorithms of blockchain are proof of work (POW), proof of stake (POS), ripple protocol consensus algorithm (RPCA), delegated proof of stake (dPOS), stellar consensus protocol (SCP), and proof of importance (POI)...” from A Brief Analysis of Blockchain Algorithms and Its Challenges by Rajalakshmi Krishnamurthi

…

China has outlawed data mining for cryptocurrency within its borders. Could well be, the Chinese top honchos are trying to tamp down their underworld. It’s also possible they don’t want the strain on their electrical grid.

“Yet another concern was that cryptocurrencies… could be used to evade restrictions on cross-border financial flows… the [Chinese] government worries that unfettered flows would make it harder to manage the renminbi’s exchange rate. In 2015-16, when China was trying to rein in massive capital outflows and stanch a steep depreciation of the currency, demand for Bitcoin from within China spiked as people used it to take money out of the country and evade the government’s controls…

“China also has taken aim at Bitcoin mining—the process by which massive amounts of computing power are devoted to validating transactions on the cryptocurrency’s network, in exchange for rewards in the form of Bitcoins… The environmental impacts, in terms of energy consumption and computer detritus, have been enormous…

The future of cryptocurrencies as financial assets is murky. But the revolution they set off will make low-cost digital payments broadly accessible…

Cryptocurrency advocates should draw the right lessons from China’s crackdown. Rather than resisting regulation and oversight, or claiming that technology will allow the industry to police itself, they should engage with governments and regulators in designing effective regulation. In turn, the industry will benefit from greater legitimacy and stability.” from China Has Good Reason to Fear Bitcoin by Cornell professor, Eswar S. Prasad, in Barons

…

So the state the problem: we need a fully secured transaction system unimpeachable by ‘third parties’ to authenticate certain abstractions, or tokens, are owned, sold and traded between anonymous entities, presumably of human origin. Transparent as all get out. Like the guy with a card table, three cups and a peanut.

The newest invention of a lock, like weapons of war, only means the inevitable lock pick. Nice try; no banana.